Use Tax

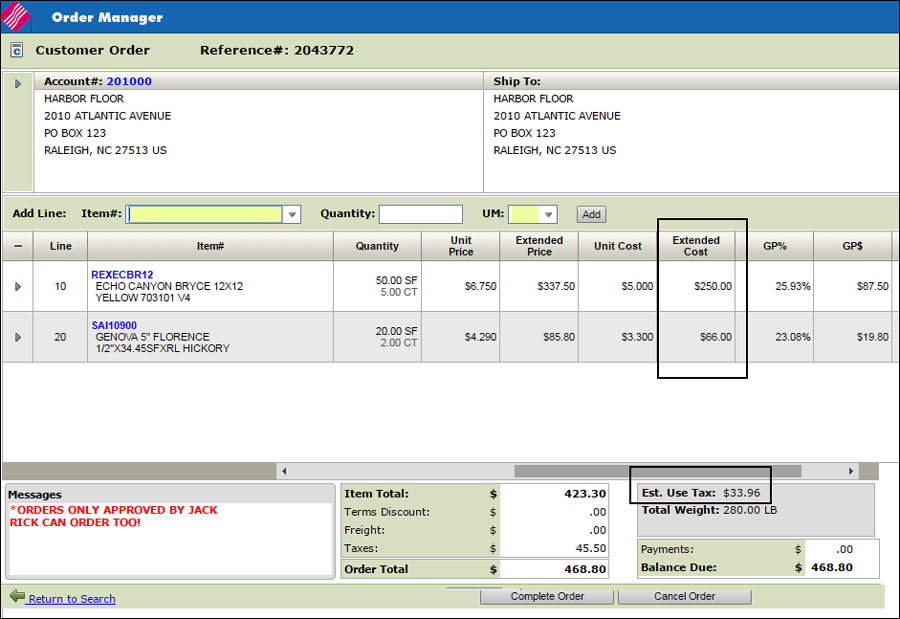

This functionality allows businesses that have to pay Use Tax (primarily installers) to see how Use Tax is going to affect their GP$/margin for the order. This also allows Use Taxes to be used in commission calculations.

Furthermore, order lines for items, usually labor items, that use ship vias not configured to calculate use tax are omitted.

- Running reports prior to invoicing to show Use Tax. The calculated and displayed Use Tax and affected GP$/GP% values are display only.

- Invoice inquiry prior to NJ will not show use tax.

- Misc (F6) Lines are excluded from use tax calculation. Cost drivers do not look at F6 lines and thus these lines will not be included in any use tax calculation.

- System-Wide Settings - Part 1 (Green Screen menu option SET 4)

- Sales Tax Report for Non-Taxed Items - Use Tax (RSA 12) - This feature allows you to run tax accrual reports for some states and items where the tax is calculated on the cost of the item. For example, use this report when samples are sent to customers at no charge or samples are used in your showroom (and billed to an intercompany account at no charge) and there is a tax liability. This is also referred to as "Use Tax". This program looks for items that (a) were sold at "no charge", (b) have special tax codes in the Item File, and (c) other items that were not charged tax.

- "X By Y" Reports With Cost Drivers - The X by Y Reports portion of the Cost Drivers menu includes report options that you can run with all or selected Cost Driver categories.

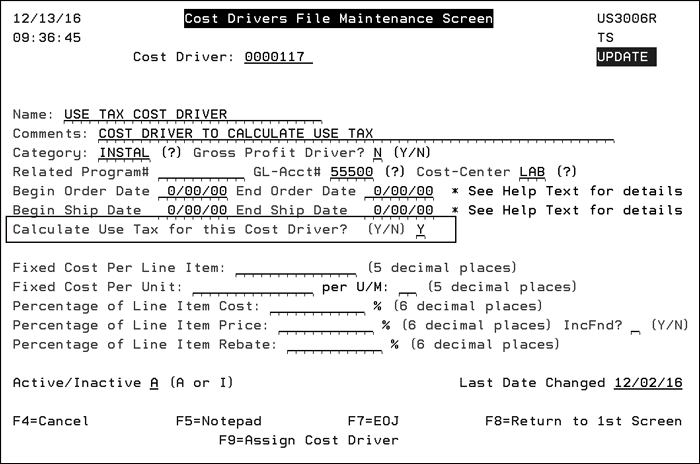

Cost Drivers (CDR 1)

Cost drivers are used to calculate the Use Tax for Invoicing.

If the setting Calculate Use Tax for this Cost Driver if activated, the values in the bottom section of the page are not needed. The system uses the following hierarchy to determine what the % rate for the cost driver will be:

- Look at the Tax by Zip Code table for the shipto zip code.

- Look at the Billto file for state/other tax codes.

- Look at the county file for the Billto.

- No tax codes found, no use tax is charged.

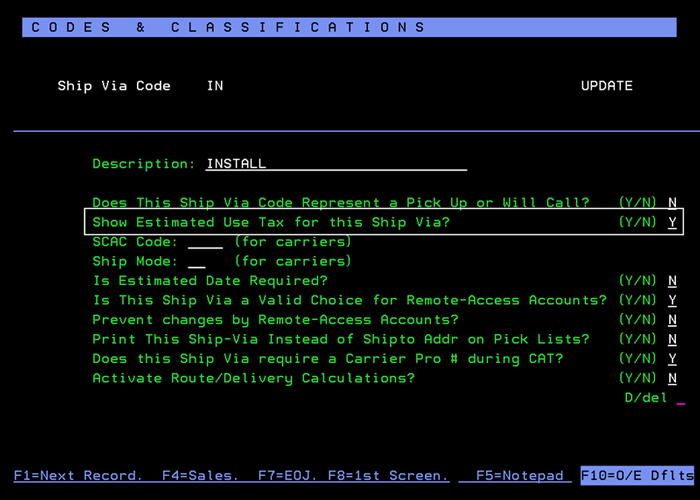

Ship Vias

Ship vias are used to calculate Use Tax in Order Management.

If the setting Show Estimated Use Tax for this Ship Via is set to "Y", and the user is able to see costs, the Estimated Use Tax appears on Navigator and Green Screen Orders.

If the ShipVia used is flagged to show estimated use tax and a cost driver is assigned that also calculates use tax, the use tax is calculated by multiplying the Extended Cost by the tax rate established in the Tax by Zip Code table for the account.

Nav OM shows estimated use tax based on a calculation on what is the expected values during invoicing. Not all of these values can be estimated (changes in average cost for instance). Values seen in OM are estimated and display only, they aren't used for reporting purposes.

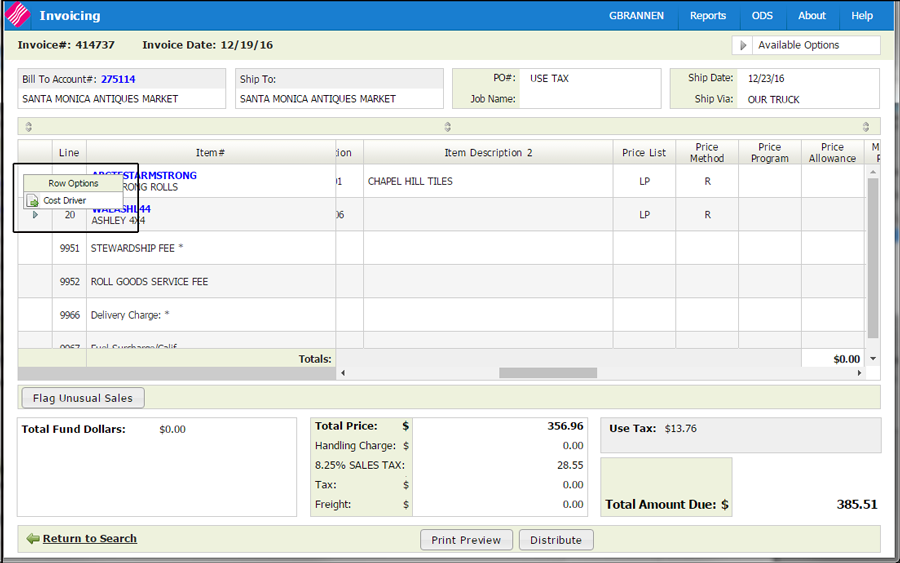

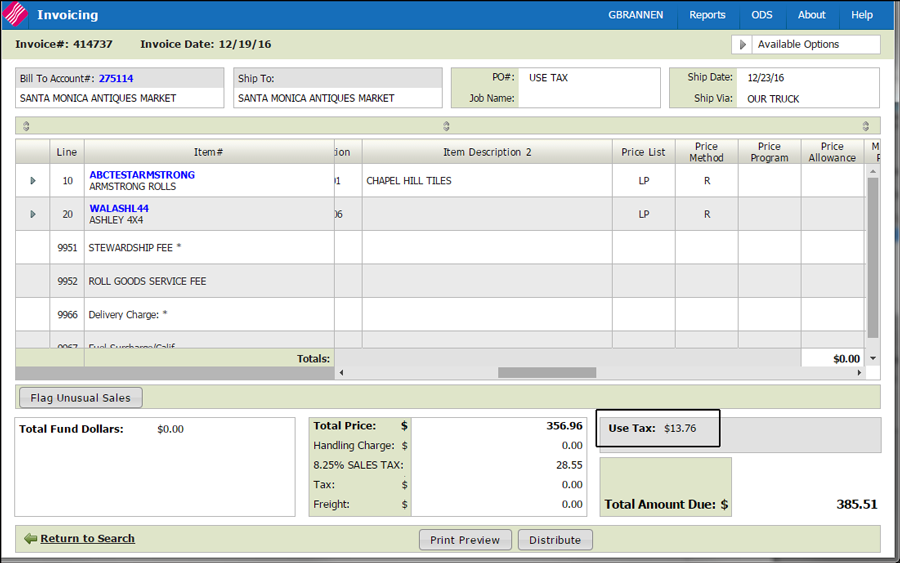

Invoicing shows the actual use tax based on the cost driver calculations done during night jobs.

The sum of cost drivers flagged for calculating Use Tax is displayed.

To see the cost drivers, click the option arrow to the left of an item and click Cost Drivers.